JetBlue and American Airlines will soon be competitors on the JFK – Edinburgh route pairing starting in 2026. Find out which carrier will likely win this route.

A few years ago, JetBlue Airways began transatlantic narrowbody service between New York City and Edinburgh, Scotland as part of their expansion into the European market. Their service “across the pond” was spearheaded by their Airbus A321neo LR equipped with their premium Mint cabin.

In late summer 2025, American Airlines announced that they will be entering the narrowbody transatlantic market also. They will start flights using their brand new Airbus A321XLRs and have their eyes set on Edinburgh as the first destination.

After months of conducting training flights between Philadelphia and Edinburgh, American is set to begin service in early January 2026.

With both airlines soon to be competing on this route, let’s examine how these former partners turned rivals will stack up against each other.

JetBlue flies to Edinburgh from both of its major hub cities in the Northeast: Boston-Logan and New York – JFK. They offer these routes seasonally, usually between May through late September or early October.

Offering this flight from multiple Northeast hubs makes sense for a lower-density European destination like Edinburgh. Edinburgh differs from that of a city like London. The demand for flights to London is likely enough for an airline to run point to point without having to worry about profitability.

Flights to Edinburgh will need to be fed from domestic connections to generate as much demand for the route pairings to remain profitable. Simply because Edinburgh isn’t as highly sought after as a destination as London is or any other major European city.

JetBlue’s Northeast dominance helps them to capture well needed demand for this flight to continue to make it worthwhile economically for the airline.

American is taking the same approach as JetBlue but adding their own twist. They are operating the A321XLR from New York – JFK, but they are also flying to Edinburgh from Philadelphia using their Boeing 787 Dreamliner.

The Dreamliner will likely yield a better customer experience than their narrowbody A321. But this also tells you that the airline expects the bulk of their demand will come through Philadelphia instead of New York.

New York isn’t American’s largest hub by any stretch of imagination. AA only owns about 11% of the market share at New York – JFK with the bulk of the flights being international.

At Philadelphia, American accounts for 36% of the market share at the airport, while featuring a mix of domestic and international options.

But why would American decide offer service to Edinburgh from two cities? Our best guess would be to capture overflow demand.

Philadelphia can likely support once a day Boeing 787 Dreamliner service, but there isn’t enough demand to necessitate adding another flight. Their service from JFK will likely grab some passenger demand that would’ve looked elsewhere if they couldn’t get on a fully booked American flight out of Philadelphia. It is also likely a response to both JetBlue and United, and their respective NYC area service to Edinburgh.

It can very well be an experiment for American. If service between New York and Edinburgh goes good, maybe the airline will replace the 787 with the A321XLR in Philly.

American Airlines is out-manuvering JetBlue when it comes to network strategy. By launching flights to Edinburgh earlier in the year, they’ll capture 100% of all demand in the NYC – JFK market until JetBlue launches their service in May.

While New York City isn’t their main focal point, American’s operation from Philadelphia will bear most of the weight while they get their narrowbody service straightened out in New York. JetBlue just doesn’t have that flexibility.

JetBlue also faces a challenge here. Since they are positioned as being one of the premiere Northeast-focused air carriers, they typically funnel their passengers from Boston or New York to destinations across the U.S, Latin America, and beyond.

They’re not really set up to reverse the flow of traffic, pulling passengers from other regions into their Northeast hubs for European flights. Typically, these passengers would focus on connecting then flying with an established legacy carrier internationally from New York.

Granted, New York and Boston are big cities and yield their own large customer demand. But overall, it’s still been a struggle for JetBlue to make these European destinations work.

JetBlue flies the Airbus A321neo LR on their transatlantic routes. They configure their cabins with lots of premium seating, the highlight being their Mint Cabin product which is basically their premium business class arrangement. Find their cabin configuration break down below:

Just for comparison, a high density configured Airbus A321 can fit well over 200 seats. So why does JetBlue put less seats on their Airbus A321neo LRs? The answer is that the airline needs to minimize weight for their transatlantic flights.

The standard A321neo LR has just enough range to reach Europe. But once you factor in required fuel reserves and winds, those range margins get a little tight to safely operate the flight. Fewer seats mean less weight and the space needed for custom fuel tanks to bring more fuel along. All of which helps increase the range of the aircraft.

American’s Airbus A321XLR is purpose-built for this exact type of flying. The plane is constructed to have the additional fuel tanks and the fuel efficiency needed for extended routes.

As of November 2025, American is planning on configuring their XLRs with the following:

The XLR’s base range of 4,700 nautical miles means it can handle the New York to Edinburgh route comfortably. But the most important part is that American doesn’t have to sacrifice seats to make operating this type of route possible with a narrowbody plane.

From a passenger perspective, the answer depends on whether you’re flying economy, or something more premium. If you’re flying business class, JetBlue’s Mint product may offer a more private, premium experience. But for economy flyers, American will likely have more seats available.

Here’s an interesting thought, JetBlue is traditionally known for being a low-cost carrier. However, for their flights to Europe they have to gamble heavily on revenue generated on premium seat options. With only 138 seats available per flight, they’re leaving significant revenue on the table compared to American’s 155 seat configuration. That means their banking on getting their Mint Cabin filled.

American’s approach allows them to be more flexible and balanced. They’re offering premium products very comparable to JetBlue and maintaining an economy cabin with more seat inventory.

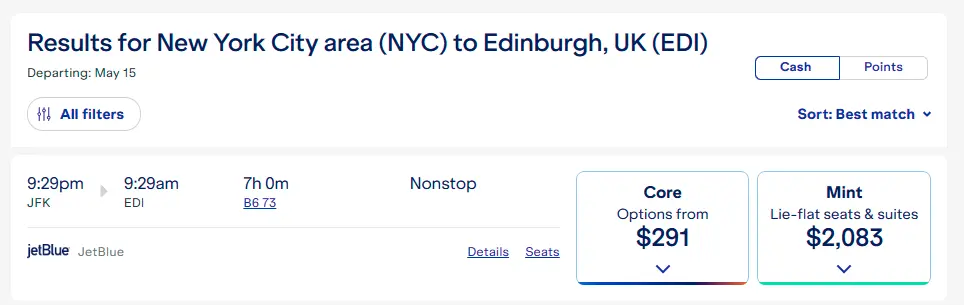

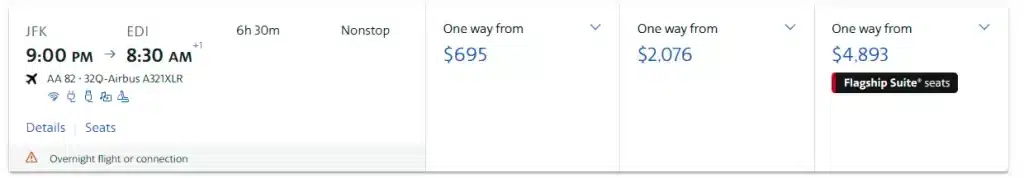

However, American is already out pricing JetBlue on this route pairing. JetBlue is charging close to $300 dollars for their economy seats and asking for about $2100 for Mint seats.

American on the other hand wants customers to pay close to $700 for economy and over $4800 for their most premium cabin product. American is nearly asking double of what JetBlue is asking. This can definitely be a factor that sways more passengers in favor of JetBlue than American.

JetBlue is making the A321neo LR work for transatlantic operations while American has found the right tool for this type of flight. This is an advantage that will prove decisive in the competition between American and JetBlue. But it appears that American might be outpricing JetBlue, focusing on generating as much revenue as possible per flight. That may or may not pay dividends for the airline.

Predicting whether a route will do well before launch is always challenging, but the writing on the wall says that American will likely win this competition.

JetBlue excels at one thing: providing low-cost options for leisure destinations from the Northeast throughout the U.S and Latin America.

Their transatlantic expansion has a record that is mixed at best. They’ve experienced frequent route cancellations and pivots. While they have had a few solid destinations like London and Paris, they just haven’t fully executed their European vision as of yet.

Their premium product offering, while very competitive, is at best comparable or slightly below par with American’s A321XLR most premium product. Let alone, not even close to most legacy carriers widebody products.

But they now have a 1 to 1 competitor with American on long and thin service from JFK. However, JetBlue will likely begin to struggle economically at least on the JFK – Edinburgh route pairing if American is successful in capturing a portion of that demand.

American will be entering the long and thin market with significant advantages over JetBlue. From a financial perspective, their product is better suited to provide better margins as long as they fill up their planes.

They have positioned themselves very well so far as they will begin flying to Edinburgh earlier than JetBlue, showcasing the airline as a viable option for Scotland bound travelers.

If American’s venture is successful, these new narrowbody transatlantic flights will serve as counter to much of United’s Boeing 737 Max 8 and future Airbus A321XLR Newark service to Europe. But, American needs to execute this first experiment flawlessly to give themselves a chance.

The ultimate competitive advantage between JetBlue and American is the A321XLR. American doesn’t have to make decisions around a weight constrained A321neo LR like JetBlue does.

While both airlines bring strengths to the table for the New York-Edinburgh market, American Airlines appears to be better positioned for success on their route pairing. They have superior aircraft, a better network strategy, higher volume capacity, and stronger transatlantic credibility which gives them several advantages over JetBlue.

For passengers, more competitive means more choices which is always a great thing. But in this “spade for spade” battle, American’s strategic planning and operational abilities means they can potentially be a force to reckon with in the transatlantic long and thin market.