American’s latest earnings report was not great. AA wants to compete with the legacy carriers but always gets stuck in it’s own way. This is how AA can adjust.

When considering traveling on the multiple airline options here in the United States, there is one thought or phrase that you don’t hear too often: “I prefer to fly on American Airlines.”

Delta has its share of blind loyalists. United has its own group of core die-hards. JetBlue and Southwest also have passionate fan bases that will defend them in any online comment section. Even Spirit Airlines has sort of a cult following of folks trying to take advantage of extreme low fares.

But American Airlines just doesn’t receive the same love. AA is essentially the black sheep of legacy carriers. They’re an airline that has made competing with United and Delta a stated executive priority, but constantly gets in its own way trying to do it.

The airline has cycled through leadership, weathered labor disputes from both pilot and flight attendant associations, and fostered an environment of internal dysfunction at times that trickled down to the product and ultimately to the passenger. It’s been a consistent negative feedback loop. The instability leads to inconsistency, inconsistency erodes trust, and that eroded trust has shown up in their latest earnings report.

In this article, we’ll break down what’s going wrong at American Airlines, how they are losing more than just a PR battle, and what they need to do, both product and strategy wise to right the ship.

Delta and United figured out something a long time ago: there are more levers to profitability than adjusting flight frequencies and ticket prices. Both airlines have made an effort to invest in their premium cabin products and loyalty programs. An investment that has paid off for both airlines.

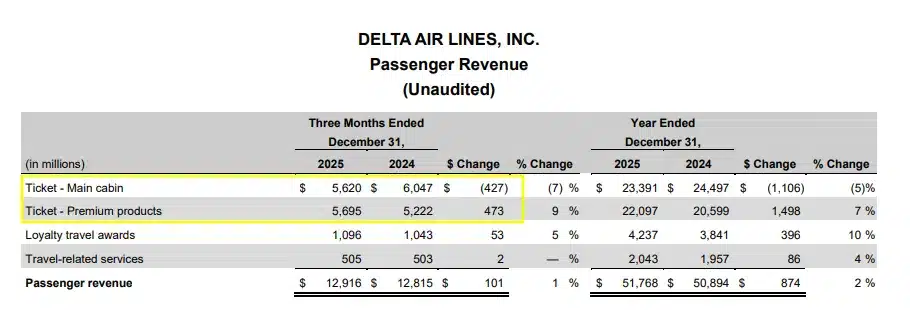

Delta’s premium cabin revenue has outperformed their main cabin revenue-wise for the first time in Q4 2025, generating $5.7 billion on premium alone versus $5.62 billion in main cabin. United saw their premium revenue jump 11% year over year in 2025, experiencing strong 9% growth in Q4 alone.

American Airlines was late to the premium bandwagon and is now playing catch-up. Their 2025 earnings report brags about their recent investment in their Flagship Suite product as well as renovations to their lounges. However, it provides zero hard revenue numbers to claim those investments are actually paying off.

But American does suffer a large problem that no amount of cabin upgrades will solve: their hubs aren’t where premium money lives.

Dallas-Fort Worth is American’s most prominent hub. It’s a major city, but it doesn’t generate the volume of high-yield corporate travelers that New York, Los Angeles, or San Francisco do.

American’s Philadelphia hub barely registers as a business center on the national stage. Their only true business-market hub is at Chicago O’Hare but they are getting decimated there. United carried 10 million more passengers through O’Hare than American in 2025.

Delta prints their premium revenue on lie-flat seats on business flights domestic and abroad, from New York City, Boston and Los Angeles. United does the same. American is trying to sell premium fares from Charlotte and Phoenix. The math won’t simply add up to be anywhere competitive with Delta and United.

And yes, American does have hub presence in New York City and Los Angeles. But they get outpaced by Delta at both LAX and JFK.

When Spirit Airlines declared bankruptcy for the second time, airlines lined up smelling the new opportunity in Florida and Latin America. Normally Spirit territory. JetBlue made a push to totally own Fort Lauderdale, Latin American, and the Caribbean corridors. American Airlines, the only legacy carrier to chase Spirit’s pending vacancy, doubled down on a network they’ve been building for decades.

With roots going back to 1991 when American purchased a portion of Pan Am’s Latin America route network, they inherited the role of America’s de facto Latin American carrier. Today, American holds a nearly 40% market share lead over the next competitor at Miami International Airport. Great news, but it comes with a ceiling.

This creates fundamental network issues for American. Latin American and Caribbean flying is driven by leisure and VFR (visiting friends and relatives) traffic. These passengers are very price sensitive. Charging premium fares on flights to Nassau or Santo Domingo won’t work, meaning that American has to be very respectful of the ultra-low-cost and low-cost fare options in the region.

| Route | Primary Market |

| Dallas (DFW) – Cancun (CUN) | Leisure |

| Miami (MIA) – Havana (HAV) | VFR (Visiting Friends and Relatives) |

| Miami (MIA) – Santo Domingo (SDQ) | VFR |

| Dallas (DFW) – Mexico City (MEX) | Leisure/ Business |

| Miami (MIA) – Cancun (CUN) | Leisure |

| Dallas (DFW) – San Jose del Cabo (SJD) | Leisure |

| Charlotte (CLT) – Cancun (CUN) | Leisure |

| Miami (MIA) – San Jose (SJO) | Leisure |

| Charlotte (CLT) – Punta Cana (PUJ) | Leisure |

| New York (JFK) – London (LHR) | Business / Leisure |

Meanwhile, Delta is selling $6,000 business class seats on flights to Paris, and the same goes for United, who is expanding their premium capacity to places like Tokyo, who received a 45% increase in 2025. These routes generate the revenue per seat that pads profit margins that American can only see in their dreams.

Meanwhile domestically, American’s earnings report showed domestic passenger unit revenue is down 2.5% year over year. The airline was quick to blame the government shutdown as one of the causes. But Delta and United, who faced the same exact shutdown, reported positive domestic trends. Again, things are just not adding up.

And now, American is chasing a third strategy: transatlantic narrowbody service. When United began aggressive route expansion to underserved European destinations using narrowbodies, American was quick to position itself as an alternative. American has the means with their acquisition of Airbus A321XLRs but they’ve already been dealt a momentum-draining blow, which we’ll get to in a moment.

Just to recap, there are three simultaneous bets going on with American right now: Latin American leisure, domestic recovery, and transatlantic narrowbody. None of them seem to be moving the needle at the moment. That’s not a solid strategy.

The recent illustration of American’s pattern of almost-getting-it-right is their rollout of the Airbus A321XLR.

While researching American’s new Philadelphia to Porto transatlantic XLR service, we came across a One Mile at a Time review of American’s XLR product on a New York-Los Angeles transcon.

The reviewer was assessing the Herringbone-style business class seats featured on the plane. Their verdict was underwhelming. But the most damning part was the passenger feedback they overheard.

Passengers were comparing the business class seats on the XLR to New York City office cubicles. The complaints also mounted from tight aisles and an unsatisfactory amount of lavatories on a plane designed for long-distance travel.

To be fair, these cramped seats and limited bathrooms are simply realities of narrowbody flying that one should expect. But for the business class product? It was a choice that American made, and it was wrong.

JetBlue’s Mint product is offered on the same exact aircraft family. It is ranked one of the best business class experiences of any U.S. carrier. The seat configuration, privacy, and white-glove service has established a reputation that punches well above the low-cost airline’s weight class.

American has virtually the same plane, serves the same opportunity, and produces something passengers are comparing to a cubicle.

However, the worst part is that these planes are eventually going to be used on flights to Europe. The feedback from the first few transcontinental flights could be the reason American has decided to slow the launch of the Philadelphia-Porto service to summer 2027. Qantas had to retrofit their XLRs with an additional lavatory after customer complaints. American should have taken that into account before accepting delivery of the first aircraft.

But this is a pattern. Delta researches, pilots, refines, then launches. United invests heavily into consistency across the fleet. American launches, collects complaints, then course-corrects.

This is a risk, especially in an era where a single viral flight review can crush public perception for months. That approach is no longer acceptable.

American’s troubles are pretty clear. Their remedies aren’t easy, but they’re not overly complicated.

1. Invest in market research before the market moves on. American is chronically reactive. There is no reason for a carrier this size to be making mistakes by learning lessons from Qantas on a plane they already accepted delivery of. They need a product development arm that anticipates where the market is going. Not chasing where it’s already been. The XLR cabin configuration was a fixable problem before a single flight left the runway.

2. Get the infighting under control. Leadership instability and public labor disputes make news. News shapes perception. When company pilots and flight attendants are at odds in the public eye about the direction of the company, that bleeds into every travel forum, Reddit thread, and conversation at the gate. Passengers are noticing this instability without even knowing the CEO’s name.

3. Stop the domestic bleeding before chasing international growth. JetBlue is a tale worth studying here. They spent years chasing international expansion while their domestic operation showed signs of deterioration. American is showing some of the same symptoms. The domestic unit revenue decline is a warning. They should address the core issue at home before thinking about expanding abroad.

4. Commit to a major business hub. This is the hardest task but the most important. American needs to make a serious, long-term commitment to a major business hub. Dallas is their spot right now but Dallas isn’t New York. American is struggling on both coasts. They are second in Los Angeles behind Delta, losing in Boston to Delta and JetBlue, and are limited at LaGuardia and Washington National by perimeter rules. They need to pick a major coastal market and go all-in. The investment will be painful at first. But the alternative of gradually fading away to irrelevancy in high-yield markets is much worse.

5. Find a lane and stay in it. American might never truly compete with Delta and United at the premium level due to their current network. But they are absolutely positioned to dominate Alaska, JetBlue, and Southwest. All low-cost carriers nipping at American’s heels right now. JetBlue in particular is vulnerable right now. They needed United’s support to survive in the Northeast, while American was standing on its own. The Northeast Alliance between JetBlue and American is dead, but American’s leverage over JetBlue is real. They just need to realize that.

American Airlines is stuck in no-man’s land right now. They’re not competitive enough to pose a challenge to United or Delta at the premium level. But they are far too large and far too deep to meaningfully accept challenging low-cost carriers on price. They are the airline equivalent of a mid-market retailer squeezed from both directions.

The reasons they are in this situation aren’t a secret. They were late to upgrade their premium products. They have inherited a route network that exists on leisure and VFR traffic that severely restricts their revenue potential. Their hubs sit in secondary business centers for corporate travel. And they have a habit of launching products before they’re ready, generating bad press, and fixing what should have been already caught during the planning stage.

The path forward for American exists. Better market research is critical. They need to fix their domestic product before expanding internationally. AA needs to commit to a major business hub. Ultimately, they need to establish a core lane and win it rather than trying to beat everyone else at their game.

American Airlines by no means is broken. But they are running out of time to stop reacting and start being a leader.